Tax Reporting

Advertisement

Minisoft AssetAge v.5 3

Assetage organizes fixed assets accounting in comprehensive formats, performs complex depreciation calculations quickly and easily, and offers powerful reports for financial and tax reporting of fixed assets.

Advertisement

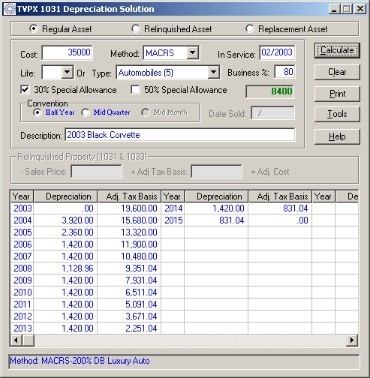

TVPX 1031 Depreciation Solution v.5.0.0001

TVPX 1031 Depreciation Solution is an extremely efficient way to calculate federal and book depreciation. All depreciation and amortization methods required for federal tax reporting are included in an easy to use calculator format.

RV Park v.3.0.4

RV Park Reservation & Management Software. This software was developed to provide a simple, yet strong, tool to manage the Reservations, Billing, and Tax reporting of an RV Park.

SmartMileage v.1.1.3.0

Mileage and Expense tracking for tax reporting. Works great for people who own their own business or are reporting mileage for expense reimbursement. SmartMileage allows for very quick entry of new mileage items by using previous entered data and

Depreciation 4562

Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation. Form 4562 is computed with a minimum amount of input. This is an idea tool for a tax professional, CPA, or anyone needing to complete tax depreciation. Asset data

MTW F/A Manager v.2.0.1

MTW F/A Manger is a complete fixed asset system which includes 5 depreciation books , management reporting, and asset tracking. Current tax rules for depreciation are built in,

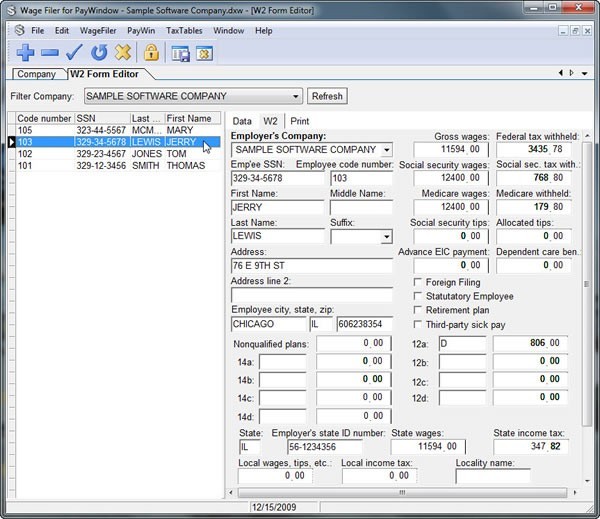

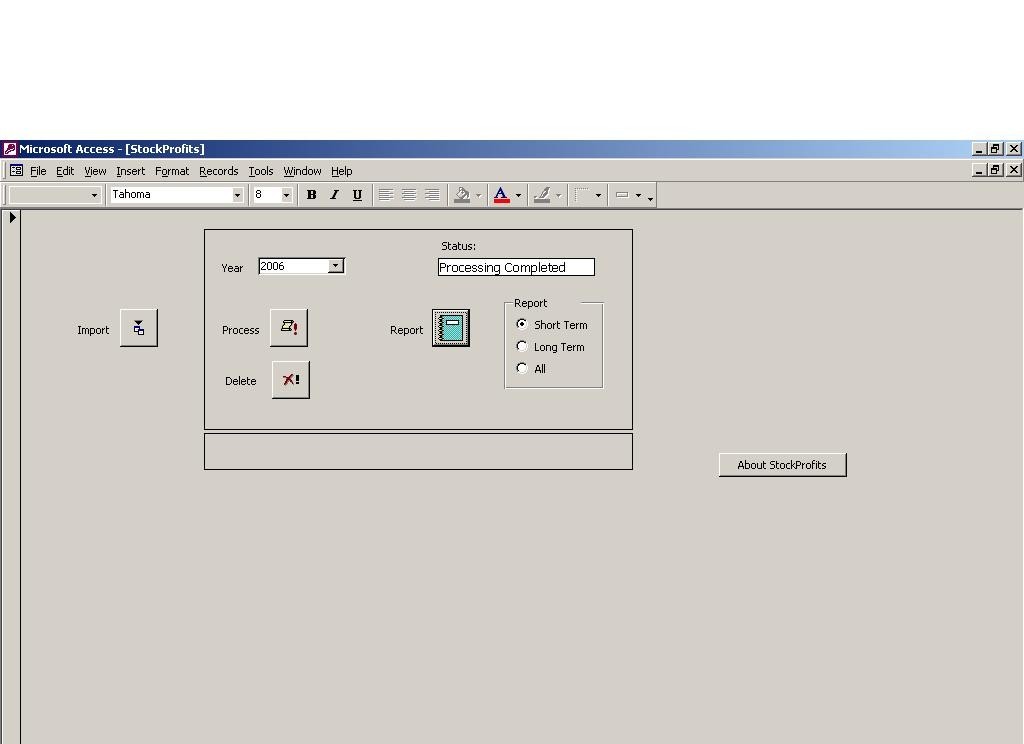

StockProfits v.2.5

StockProfits is a utility which will help those of us who make lots of trades with a stock broker every year.

Best Accounting Basic v.7.00

Based on Best CashBook, it gives all financial statements plus sale, purchase, inventory, customer, supplier and VAT(or sales tax) reports. It can be utilized in any languages because you can directly shape all financial statements, invoices and VAT.

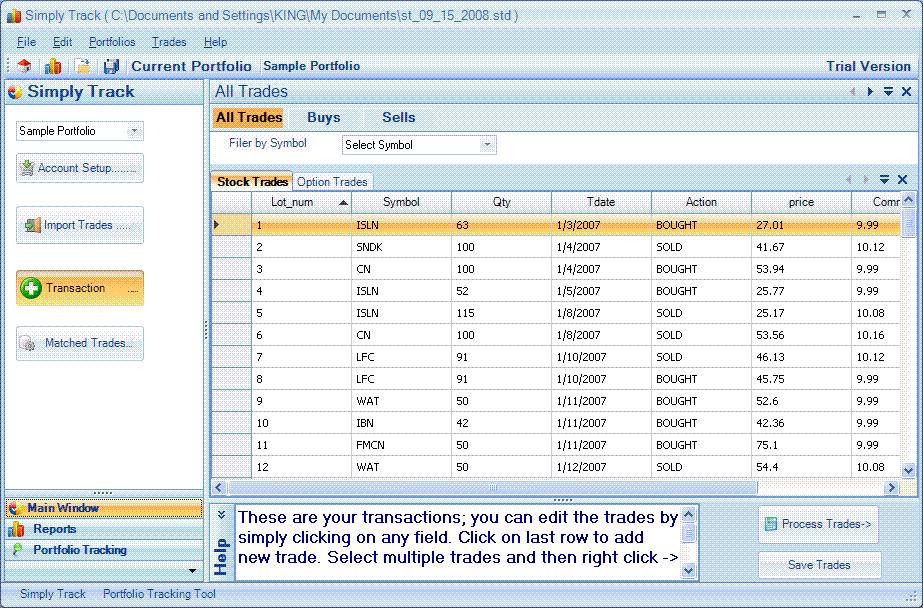

Simply Track Pro v.3.3

Simply Track , is an easy-to-use stand alone application that simplifies portfolio tracking and IRS Schedule D generation.

TVPX 1031Depreciation Solution v.5.5

TVPX 1031 Depreciation Solution is an extremely efficient way to calculate federal and book depreciation.